براہ کرم انتظار فرمائیے۔۔۔

براہ کرم انتظار فرمائیے۔۔۔| IMPORTANT NOTE: You can apply here on different Govt Schemes only! |

|---|

|

| Active Government Schemes Details | ||||

|---|---|---|---|---|

| There are no Govt Schemes available at EPR yet! Keep visiting for updates. Thank you | ||||

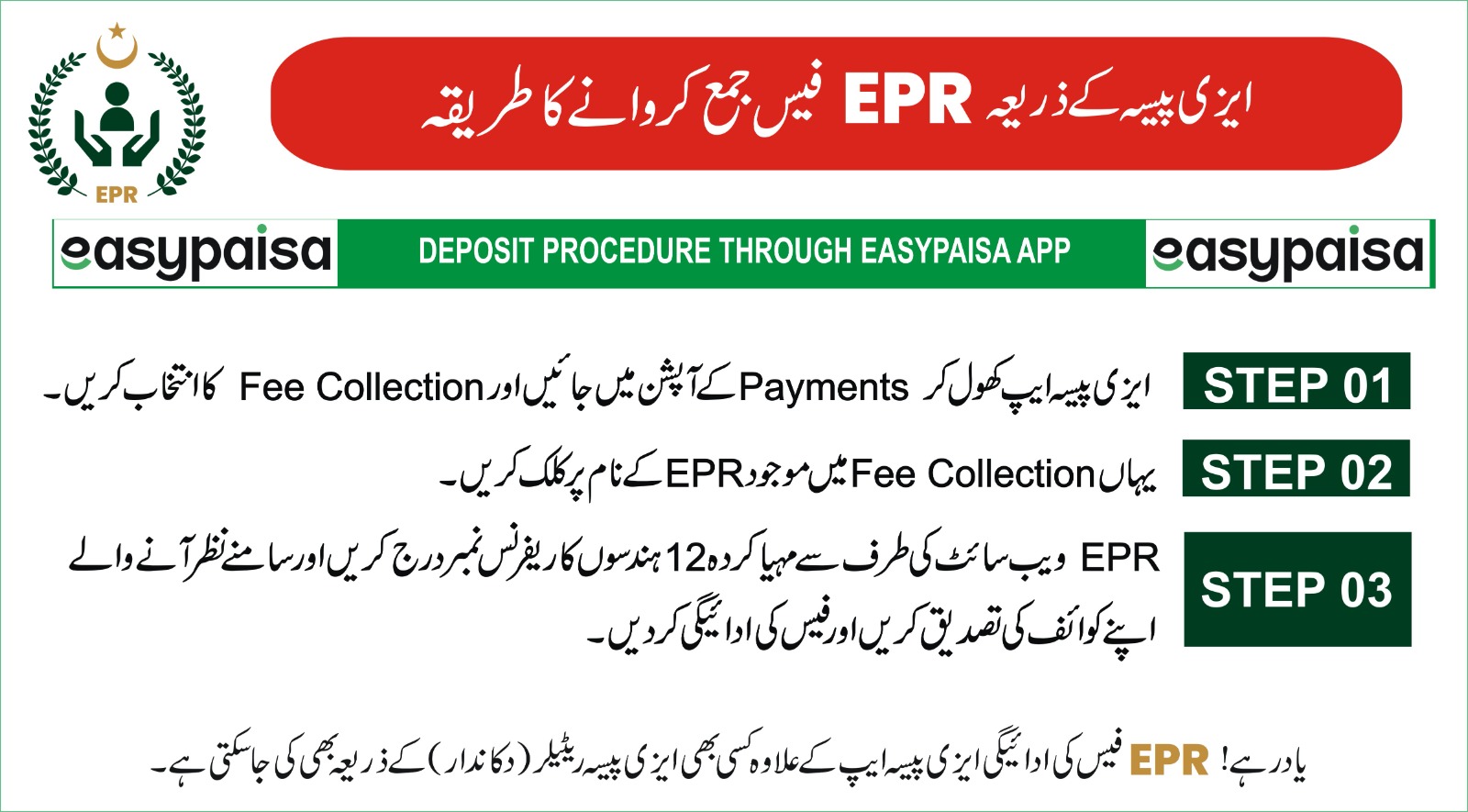

| Pay VIA Easy Paisa | |

|

|

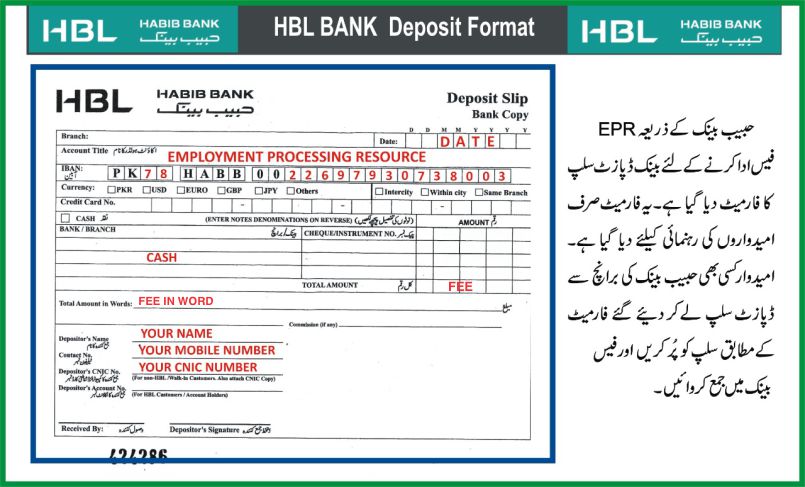

| Pay VIA HBL | |

|

|

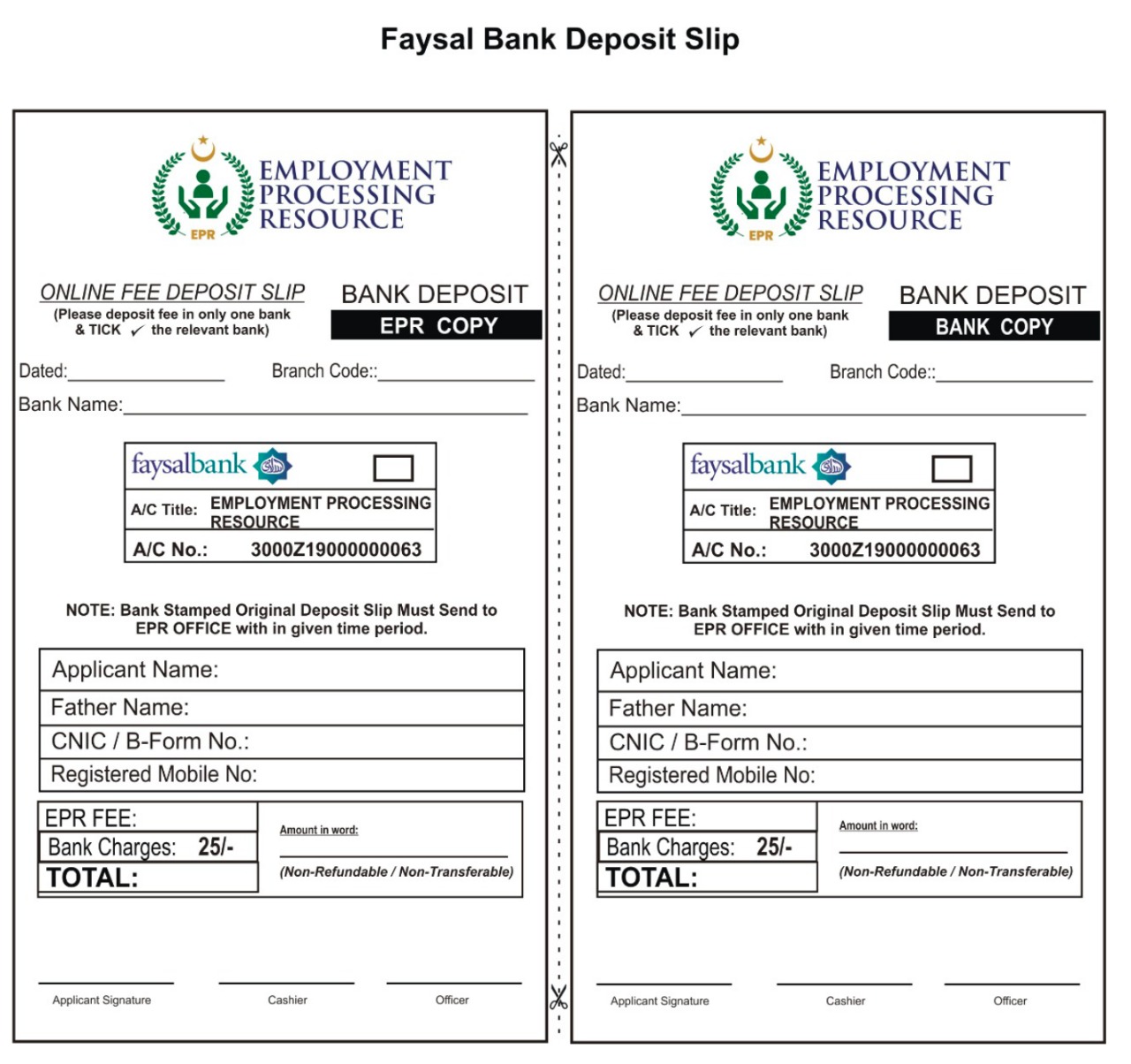

| Pay VIA Faysal Bank | Download Form |

|

|